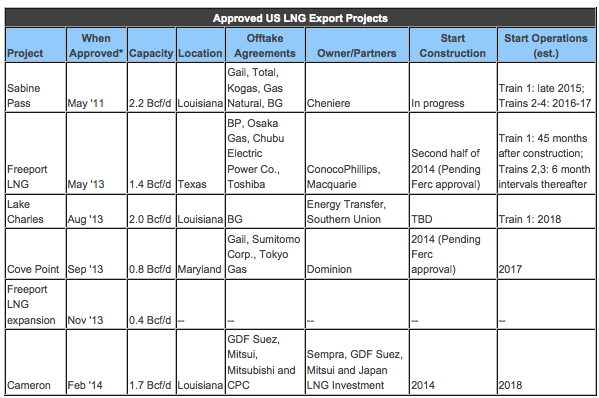

With their traditional oil-linked pricing formulas under pressure from the prospect of US exports linked to US gas benchmark Henry Hub, established LNG producers are only too happy to stress the risks involved in US deals. They point out that only one project, Cheniere Energy’s Sabine Pass, has actually taken a final investment decision, and that no one knows how much US gas will be exported as red tape continues to entangle the long queue of projects seeking export rights from the US Department of Energy (DOE).

Nonetheless, six schemes have secured approval to export gas to most global destinations and are eyeing start-up between 2016 and 2018, provided they can overcome logistical and financing hurdles. Assuming they ran at full capacity, they would export 12.87 billion cubic feet per day of gas or around 90 million tons per year of LNG. Cheniere plans to start operations at the first Sabine Pass train by late 2015, with Trains 2-4 coming on line in 2016-17 (see table). Earlier this year, the DOE granted authorization for more exports from Trains 5 and 6 to countries with which the US has free trade agreements (FTA) — a select group that excludes top LNG importer Japan — hoisting total capacity from all six trains to around 9 million tons/yr. Sabine Pass’ request for the option to export to non-FTA countries will be considered by the DOE separately — presumably behind the nearly 20 other applications in the DOE’s non-FTA queue. Cheniere is also busy seeking customers and partners for its planned Corpus Christi LNG project, with Spanish utility Endesa and Indonesia’s state Pertamina both set to take output. Cheniere has signed up San Francisco-based Bechtel to build the project, as it has at Sabine Pass.

Dominion’s Cove Point LNG — which has existing infrastructure in the US mid-Atlantic — secured non-FTA export approval last year and may be the second project on line after Sabine Pass. Dominion recently filed with US regulators to raise about $400 million in an initial public offering. The project, which plans to start construction in 2014 pending Federal Energy Regulatory Commission approval for the infrastructure, is eyeing a 2017 start date and has offtake agreements with India’s Gail, and Japanese firms Sumitomo and Tokyo Gas.

If all goes to plan, the third project likely to see the light of day is Trunkline LNG, which last year won approval to export 15 million tons/yr to non-FTA countries. In October, owner Energy Transfer signed a deal with UK gas giant BG for joint construction of the export complex at Lake Charles, Louisiana, previously the site of an import terminal. They have not given a construction start date, but hope to begin exports in 2018.

Sempra’s Cameron LNG is also high in the pecking order. In February, it became the latest project to gain DOE non-FTA approval, and has offtake agreements with GDF Suez, Mitsui, Mitsubishi and Taiwan’s state CPC. The aim is to start construction later this year and have the first full year of three-train production in 2019.

For all these “top” projects, a crucial consideration is the status of work on the Panama Canal, which can’t be used by LNG carriers until a third set of locks is built. Using the canal will be the quickest way of getting cargoes originating on the US Gulf Coast to Asia, and the widening of the waterway will allow about 90% of LNG carrier traffic to pass, albeit on a limited schedule as only six vessels, of any kind, will be able to pass through each way daily. The work was supposed to be completed this year to coincide with the 100th anniversary of the canal’s opening. But a serious contracting dispute, now apparently resolved — centering on who should bear the burden of cost overruns — has pushed back the completion date to early 2016, slightly later than the Sabine Pass Train 1 launch.

One US export project that need not worry about the canal is a plant planned in south-central Alaska to move the state’s stranded North Slope gas to Pacific Rim markets. The Alaska legislature on Apr. 20 approved a legal framework for the project, after the governor signed a heads of agreement with partners Exxon Mobil, BP, ConocoPhillips and TransCanada earlier this year. The project, which Exxon Chief Executive Rex Tillerson has indicated will cost over $50 billion, would export up to 18 million tons/yr, although the first cargo is likely more than a decade away.

Two planned export projects in the US West Coast state of Oregon could come on line much sooner, but face serious political obstacles. Operating permits need to be approved by host state governments, and authorities in Oregon have in the past threatened to withhold such permits for LNG infrastructure.

*Approval refers to export rights to countries with and without free trade agreements with the US.

Sources: Energy Intelligence, US Department of Energy.

Add a comment